profit and loss statement (P&L)

What is a profit and loss statement (P&L)?

A profit and loss statement (P&L), also called an income statement or statement of operations, is a financial report that shows a company's revenues, expenses and net profit or loss over a given period of time. The time period can be of any length, but it is usually a month, quarter or year. It can also be based on either the calendar year or fiscal year.

The P&L statement is one of three major statements typically included in the financial reporting process. The other two are the balance sheet and cash flow statement. A balance sheet provides a snapshot of an organization's assets, debts and equity at a specific point in time. A P&L statement is more concerned with an organization's profitability over a period. A cash flow statement differs from both of these. It shows how much cash flowed into and out of the organization during a specific time period.

Organizations often produce P&L statements to comply with U.S. Security Exchange Commission (SEC) rules -- such as the Sarbanes-Oxley Act of 2002 -- or to meet other standards or regulatory requirements. However, business owners and managers also use P&L statements, along with other financial information, to better understand how well their organizations are doing and to identify where they might need to improve their operations. Investors and lenders also refer to P&L statements and other financial documents to learn how well an organization is performing.

How do you read a P&L statement?

The P&L statement measures revenues against expenses to arrive at the organization's overall profits or losses during the reporting period. At its most basic, an organization's P&L statement includes:

- Total revenue. The total amount of income the organization earned from its core products or services. Income might be broken down into separate categories for products or services.

- Gross profit. The total revenue minus the cost of goods sold (COGS). The COGS amount includes the expenses a company incurs in selling its products or services. For example, COGs might include raw materials, packaging or transportation costs. This amount is then deducted from the total revenue.

- Operating expenses. This includes any expenses not directly related to delivering the core products or services, such as rent, utilities, insurance or marketing costs.

- Net profit/loss. This is the amount of profit or loss the organization can show after deducting the total expenses from the gross profit. This amount is often referred to as the bottom line.

When preparing their P&L statements, organizations might use acceptable alternative category names such as gross revenue, net sales, gross margin, or net revenue.

P&L statements often include other information, especially when public companies issue the statements. For example, many P&L statements contain an entry for operating income, which lists the organization's profits before taking into account expenses such as interest or taxes. The P&L statement might also list other sources of income or expenses, including interest and taxes.

Figure 1 shows a sample P&L statement from Apple Inc. It is part of Apple's consolidated financial statements for the first quarter of fiscal year 2023. Notice that the statement includes categories such as total net sales (total revenue), gross margin, operating expenses, operating income, and net income (net profit).

When organizations prepare their P&L statements, they typically use one of two reporting methods:

- Cash method. The reported income and expenses are based on when payments are actually delivered or received, as opposed to when the products or services themselves are delivered or received. For example, a sale is not included in the total revenue until payment is received. The same goes for expenses. The cost of a service or material is not included in the calculations until the payment for that service occurs. Smaller companies and individuals often use this method

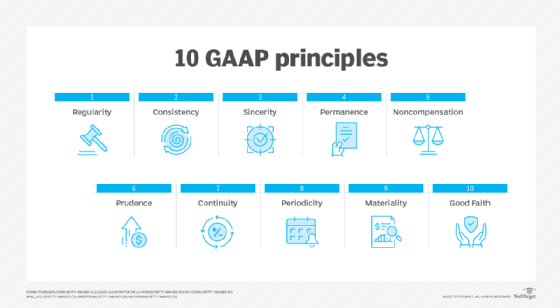

- Accrual method. The reported income and expenses are based on when the transactions occur, rather than when payments are made or received. A company will record when it has delivered a product to the customer, regardless of when the organization actually receives payment. Similarly, if the organization receives a delivery of raw materials, those materials are treated as an expense, even if no payment is made until the following month. Public companies tend to use the accrual method, which is also favored in the generally accepted accounting principles (GAAP) rules and standards.

Companies can use a variety of resources to track and report financial information; automated financial reporting processes are recommended and call for organizations to maintain rigorous data governance. This can often be accomplished with the finance modules in enterprise resource planning (ERP) systems or by adopting specialized financial reporting software.

Explore how to solve GAAP vs. International Financial Reporting Standards and other accounting challenges. See how finance transformation efforts soar with cloud ERP. Check out how financial institutions can streamline compliance with AI.