Getty Images/iStockphoto

Broadcom to sell VMware EUC division to KKR for $3.8B

Customers that pair VMware's hypervisor with Horizon and Workspace One desktops might feel licensing jitters, but the deal could lead to more flexibility.

Chip vendor Broadcom plans to sell VMware's end-user computing division to private equity firm KKR for $3.8 billion later this year.

Broadcom acquired VMware late last year for $61 billion after a long period of international regulatory scrutiny. Since then, the company has worked to recoup its VMware acquisition costs through streamlining product lines, ending perpetual licenses for a number of products, and selling off lower-revenue pieces including the EUC division and -- to come -- VMware's security division that includes Carbon Black.

"The [product] diversification attempts by VMware were always questionable," said Holger Mueller, an analyst at Constellation Research. "It's clear they didn't make any sense because otherwise [Broadcom] wouldn't be selling it off. There would be certain synergies."

The EUC Division -- which includes flagship products Workspace One and Horizon virtual desktops -- will continue to be overseen by VMware's current management team led by Shankar Iyer, KKR said.

Virtual desktop growth potential

KKR's acquisition of VMware EUC tools could lead to some confusion regarding licensing for customers that are entitled to vSphere as part of the Horizon license. Users might have to worry about pricing changes as they will be dealing with two companies, said Gabe Knuth, an analyst at TechTarget's Enterprise Strategy Group.

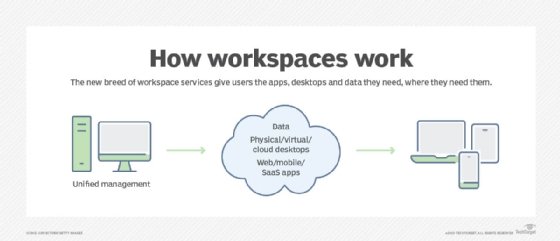

Before and after Broadcom's acquisition, VMware worked to make Horizon and Workspace One function natively not just in VMware's cloud, but in Microsoft Azure, AWS and other environments. Analysts expect the tools to become even more flexible as KKR seeks to grow its customer base en route to possibly going public with VMware EUC or reselling it.

While it might be tempting to compare KKR's acquisition of VMware EUC to its rival Citrix's acquisition by Vista Equity Partners in 2022, Knuth said that deal was much more complicated. It was more than four times larger at $16.5 billion, Vista acquired much more technology, and the sell-off was driven by activist investors. With fewer moving parts to the VMware properties and the retention of senior leadership, KKR could find a smoother path to revenues.

"It's conceivable that, with minimal touch -- at least compared to Citrix -- VMware EUC can be a valuable piece of KKR's portfolio, maybe even eventually going public again," Knuth said.

A number of tech trend analysis firms project virtual desktop growth of more than 10% in the coming years as more companies use the technology to deliver computing resources to remote employees.

Mueller said he believes desktop virtualization and digital workspaces still have a lot of growth potential. Though the technologies have not taken off as many industry observers thought they might over the years, industries such as healthcare are moving toward stateless -- or device-independent -- desktops for employees who can work from a phone, tablet or laptop depending on their physical work environment.

"As long as the performance is there, as an employee, you don't care what is running under the hood," Mueller said.

Further, virtualization gives IT departments more control over the applications their remote workers use, and makes upgrading apps and security more straightforward, he continued. Virtual desktops can run on devices such as Chromebooks and thin clients that cost less than traditional PCs. The benefits could mean that desktop virtualization, which has been around since the 1960s, still has a chance to grab significantly more market share.

Don Fluckinger is a senior news writer for TechTarget Editorial. He covers customer experience, digital experience management and end-user computing. Got a tip? Email him.