Getty Images/iStockphoto

Health of digital transformation: Consulting firms list issues

Digital transformation can take too long and fail to deliver. Root causes include lack of focus, cultural barriers and technical challenges, according to IT services executives.

Digital transformation consulting practitioners are working with organizations to troubleshoot initiatives that struggle to meet expectations and face the rigors of a turbulent economy.

A decade into efforts that promised to set businesses and government agencies on a digital course, some customers have grown frustrated with lengthy delivery timelines, questionable results, stubborn legacy systems and cultural obstacles.

While widespread cloud adoption and digital acceleration had been the rule at enterprises in recent years, market reports point to management impatience, underwhelming outcomes and signs of retrenchment.

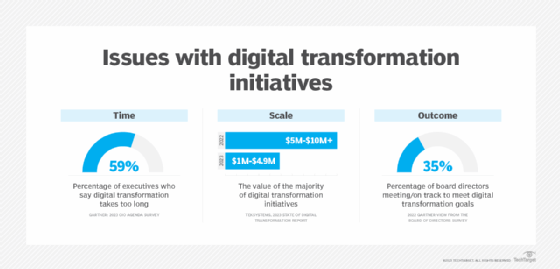

- Gartner's "2023 CIO Agenda" survey reported 59% of executives believe digital initiatives take too long to complete. The "2022 Gartner View From the Board of Directors Survey" found 89% of board directors believe digital business is embedded in their growth strategies, but only 35% of that group said they have achieved, or are on track to meet, their digital transformation goals.

- Most organizations shifted fewer of their processes to digital during 2022, according to the Info-Tech Research Group's "CIO Priorities 2023" report. Only 4% of the IT professionals polled said they digitalized more than 60% of their manual processes last year, compared with 22% in 2021. "We see organizations taking their foot off the gas pedal of digitalization and shifting their focus to extracting the value from their investments," the report noted.

- TEKsystems' "2023 State of Digital Transformation" report released last week reveals a shift to smaller digital transformation efforts. Twenty-one percent of the organizations polled said they plan to spend $10 million or more per digital initiative this year compared to the 34% of respondents reporting spending in that range in the 2022 survey. Organizations now focus on smaller-scale projects in the $1 million to $4.9 million range, as 2023 spend falls under greater scrutiny, according to the company.

"Those large-scale modernization and mass-migration efforts that really spurred a lot of the transformation spend are getting cut back," said Ricardo Madan, senior vice president of global technology services at TEKsystems, a business and technology solutions provider based in Hanover, Md.

Taking a step back

Against that backdrop, companies are reviewing the practice of transformation.

"With trillions invested in this whole transformation journey by so many large enterprises worldwide, it's probably time to take a step back," said Sateesh Seetharamiah, CEO of EdgeVerve, a subsidiary of global systems integrator Infosys.

"Five or six years ago, everybody was talking about digital and cloud," said Dee Burger, president of Insight North America, a solutions integration based in Chandler, Ariz. "Now, there is a rationalization of all that has come before and a large focus on getting quite specific on what is useful, what is going to be done and what isn't," Burger said. "It's a natural evolution of any technology cycle."

Sumeet Sabharwal, CEO at Netgain Technology, an MSP based in Minnetonka, Minn., also noted the turn toward greater specificity in transformation projects.

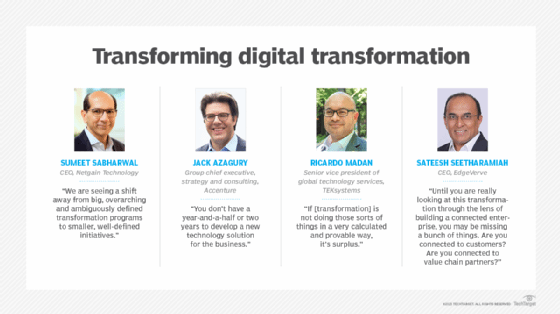

"We are seeing a shift away from big, overarching and ambiguously defined transformation programs to smaller, well-defined initiatives," Sabharwal said. The latter aim to alleviate pain points, reduce manual labor, improve end-user experience and deliver tangible business results, he noted.

"Unfortunately, the IT industry has a long history of runaway programs, from ambitious and ill-defined ERP or EHR implementations to large-scale digital transformation initiatives," Sabharwal added.

Project size isn't the only dimension getting squeezed. Jack Azagury, group chief executive, strategy and consulting, at Dublin, Ireland-based Accenture, said it's not so much that companies are breaking up digital transformation projects but compressing their timelines.

"What used to take years now has to be done in months, and what used to take months now has to be done in weeks," he said. "You don't have a year-and-a-half or two years to develop a new technology solution for the business. You don't know what the business will look like in two years."

The digital diagnosis

Industry executives mostly agree that digital transformation could use a dose of introspection, if not something a bit stronger. The diagnosis varies, however.

Some observers attribute the glacial pace of transformation to the scope and complexity of such journeys -- and the tendency among businesses to lose the plot along the way.

"Transformations nowadays are inherently difficult to manage, and if not managed properly, they tend to drag on," said Greg Stam, managing director of CIO Advisory at Ahead, a cloud and data engineering consulting firm based in Chicago.

Clients often call the company, saying their program is stuck. The reason usually "comes back to a lack of focus: what transformations take top priority and what goals is this transformation aiming to achieve?" he said.

Other digital transformation consulting leaders point to cultural considerations and the weight of previous technology investment.

"Digital transformation initiatives take longer than planned because of cultural change barriers, underestimated legacy modernization complexity and the cost overruns," said Ajay Tyagi, executive vice president, digital, product and platform services at Movate, a technology consulting and customer experience company with headquarters in Plano, Texas.

David Chou, director of cloud capabilities at Leidos, a technology, engineering, and science solutions and services provider based in Reston, Va., also cited cultural issues and the problem of misjudging the challenge of digital transformation. He said some organizations view digital transformation as a task to complete or a fire-and-forget technology rollout. They underestimate the extent to which transformation fundamentally changes how they operate -- and the time it will take to absorb new ways of working.

"That is what drives the frustration in terms of timelines and outcomes," Chou said.

Compounding matters, digital initiatives are getting harder to pull off. Having tackled the low-hanging fruit of transformation, organizations now attend to "core transformation projects," said CR Srinivasan, executive vice president, cloud and cybersecurity services and chief digital officer at Tata Communications, which provides unified communications as a service, multi-cloud offerings and managed infrastructure services.

Those core projects involve data quality, process simplification, employee upskilling and a data-driven decision-making culture, Srinivasan noted. Such initiatives are possibly taking longer because organizations haven't linked them to organizational change management initiatives, he added.

Limited interoperability also plays a role in hindering success. The rush to digitalize in the COVID era had businesses adopting a multitude of SaaS products and infrastructure services. A good chunk of the purchasing occurred beyond centralized IT, with sales, marketing and other business functions among the cloud buyers.

Integration suffers as a result. EdgeVerve's Seetharamiah cited the lack of effective linkages among enterprise functions, which end up operating as digital silos. The same problem surfaces between the enterprise and its external stakeholders.

"You can digitalize a lot of things," he said. "But until you are really looking at this transformation through the lens of building a connected enterprise, you may be missing a bunch of things. Are you connected to customers? Are you connected to value chain partners? Enterprises have a long way to go in this."

Add legacy technology to the kludge of cloud offerings and the interoperability problem becomes even more vexing. Interoperability already ranks among the top 2023 challenges for CIOs.

"The hardest part is where [organizations] deal with a significant amount of technology debt," Accenture's Azagury noted.

Rationalization and optimization

Businesses with 10- to 20-year old technology will find it especially difficult to reach their desired transformational end state, Azagury said. Accordingly, many companies now emphasize application rationalization -- trimming the number of systems to achieve a much cleaner architecture, he said.

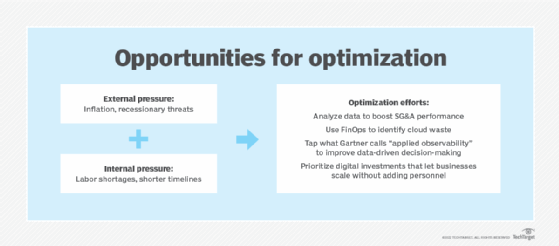

Rationalizing digital assets and optimizing technology investment are poised to characterize digital transformation in 2023.

"The appetite is a lot higher to really optimize," TEKsystems' Madan noted. "[Organizations] spend all of this money and make all of these investments, but where is the tangible, monetized, quantified return?"

The task at hand is realigning digital transformation with the most pressing business concerns: driving revenue, boosting efficiency and improving customer experience. "If it's not doing those sorts of things in a very calculated and provable way, it's surplus," Madan said.