2 Salesforce acquisitions in 2023 close year of austerity

In a year that began with layoffs, Salesforce changed its tune about acquisitions. Instead, it invested more, aiming to aid companies with products that its customers need.

Entering 2023, Salesforce received backlash from investors about its spending practices. After a round of layoffs and other cost-cutting efforts, a year of acquisitions was unlikely.

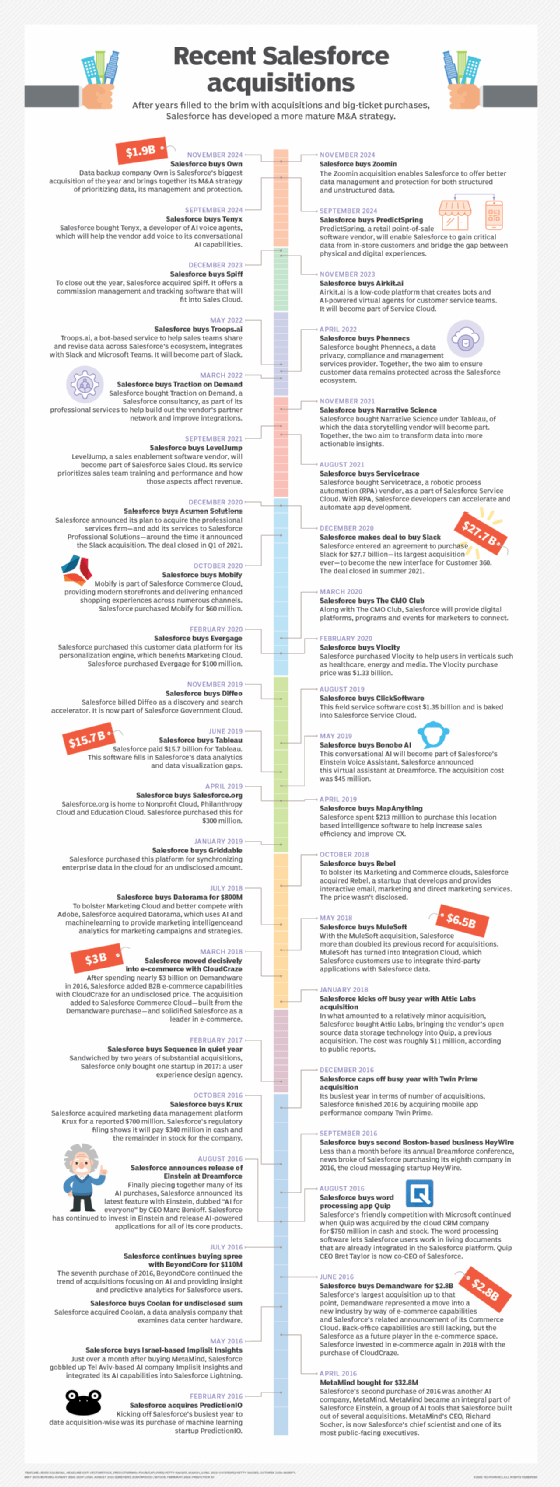

Instead of a year full of generative AI vendor acquisitions -- which many people may have expected -- Salesforce acquired two companies and invested in various others. The CRM vendor focused more on Ventures, its venture capital arm that launched in 2009, and on creating a network of partners its customers can use and the company can help grow until it potentially acquires them.

However, AI wasn't forgotten in the "year of austerity," according to Liz Miller, vice president and principal analyst at Constellation Research. The acquisition of Airkit.ai, a low-code/no-code bot builder for customer service, and the many updates to Einstein prove that Salesforce still has its eye on generative AI.

"When you add up the dollars, did they get to Slack money? No. But they're investing," Miller said. "They're pushing … a lot of that cash into Ventures and trying to figure out what customers demand native integrations [with], so they can see if they can make generative AI actually work."

Salesforce will likely aim to connect future acquisitions with past purchases and existing systems. For example, Airkit.ai goes hand-in-hand with last year's acquisition of Troops.ai. Troops.ai can create business apps, automation and AI workflows in Slack and Microsoft Teams, while Airkit.ai creates bots and enables rapid bot deployment. Airkit.ai does the same thing for automation and AI as Troops.ai did for team collaboration, Miller said.

Additionally, Salesforce acquired Spiff, which offers commission management and tracking software and will fit into the vendor's Sales Performance Management suite. It helps sales leaders manage team workflows and communication to ensure reps receive their commissions. Like Airkit.ai, Spiff was part of Ventures. According to Miller, it shows a trend of Salesforce bringing low-code systems directly into the fold as admins and users crave tools they can quickly build and deploy.

Overall, Salesforce is still filling in its platforms' gaps. The company could head in several necessary directions in 2024, like focusing on data, content generation, ERP or content analytics, Miller said. Yet, acquisition sprees like those in years past are unlikely. Miller expects Salesforce to carry over its cost-cutting lessons from this year and continue to invest in Ventures partners that its customers value most.

"They're going to have an interesting year no matter what. Something has to come after AI," Miller said.

Michaela Goss is the site editor for TechTarget's customer experience and content management sites. She joined TechTarget as a writer and editor in 2018.

Editor's note: This article was updated to include information about Salesforce's acquisition of Spiff in December 2023.