Small Disadvantaged Business (SDB)

What is a Small Disadvantaged Business (SDB)?

A Small Disadvantaged Business (SDB) is a small business that is at least 51% owned and controlled by one or more socially and economically disadvantaged individuals. SDB status makes a company eligible for bidding and contracting benefit programs involved with federal procurement.

How did the Small Disadvantaged Businesses originate?

The SDB program was created in 1979 by Public Law 95-507 as an amendment to the Small Business Act. It is intended to help small businesses that are owned and controlled by socially and economically disadvantaged individuals compete for federal contracts.

The SDB program is based on the principle that small businesses owned by these individuals face unique challenges in competing for federal contracts and that they should be given equitable treatment in the procurement process.

What are the benefits of being a Small Disadvantaged Businesses?

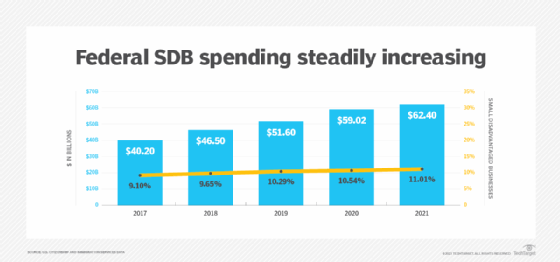

In fiscal year 2021, SDBs received $62.4 billion in federal contracts, which represents 11% of all federal contracts awarded. This is a significant increase from the SDB program's early years, when SDBs received only a small fraction of federal contracts.

Businesses receive multiple resources when they acquire SDB status. One key benefit is the increased opportunity to bid on federal contracts, as this status provides greater access to these lucrative deals.

In addition, SDB businesses are given preferential treatment during the procurement process to increase their chances of securing contracts, thereby making the overall process more equitable. They also become eligible for financial aid and other resources provided by the SBA -- a critical factor for businesses seeking to expand and solidify their operations.

Furthermore, being an SDB can enhance a business's visibility and credibility among potential customers, adding a competitive edge to the business and potentially driving growth.

How to apply for designation as a Small Disadvantaged Business

To become an SDB, a business must first be certified by the SBA. The SBA program has a few requirements that must be met to qualify for SDB certification:

- The business must be small, as defined by the SBA.

- The business must be controlled by one or more socially and economically disadvantaged individuals.

- The business must be at least 51% owned by these individuals.

Once a business is certified by the SBA, it will be eligible for all benefits offered by the SDB program.

What are the challenges of being a Small Disadvantaged Business?

Despite the praise the SDB program has received, it is not without its challenges and criticisms. Some critics have taken issue with perceived "preferential treatment" SDBs receive.

Furthermore, businesses within the program also face a host of challenges. These include competition from larger, more established businesses that can leverage their resources and experience to secure contracts.

They struggle with limited access to capital and other resources essential for business growth and stability. Often they must grapple with the stringent requirements that come with government contracts, which can be complex and demanding.

However, even in the face of these challenges and criticisms, SDBs have shown they can thrive in the federal marketplace. Therefore it's likely the SDB program will continue to be a part of the federal procurement process in the future, serving as a valuable mechanism to level the playing field for disadvantaged businesses.

See why minority access to federal contracts needs improvement, and learn 7 keys to a successful diversity and inclusion initiative. Explore 20 diversity and inclusion tools to power your DEI program and see why U.S. officials employers need to adopt skills-based hiring.