- March 29, 2024

- Content, Market Intelligence

Five Top Technology Investment Drivers for 2024

The technology landscape is poised for significant change in 2024, with many purchase drivers and disruptors impacting your current customers’ and prospects’ tech investments.

It’s essential organizations, like yours, stay on top of these rapidly evolving macro-trends to:

- Understand how your current and future customers’ top tech challenges and goals are influenced, from cybersecurity and risk management to IT automation.

- Align your marketing message and sales outreach efforts with these drivers’ challenges and pain points to explain how your solution solves customers’ issues.

- Promote or develop content, in tandem with your marketing and sales message, that reflects these tech trends, as they’re likely to be top-of-mind for your buyers.

- Gauge if and where there’s inherent market interest in your product area(s).

To gain better insight into trends, TechTarget and Enterprise Strategy Group ran our 2024 Media Consumption Study. In it, we found these disruptors range from cybersecurity risks, like internal threat actors and Ransomware as a Service (RaaS), to widespread IT skills shortages, expanding cloud deployments, hybrid workforce needs and raw business growth.

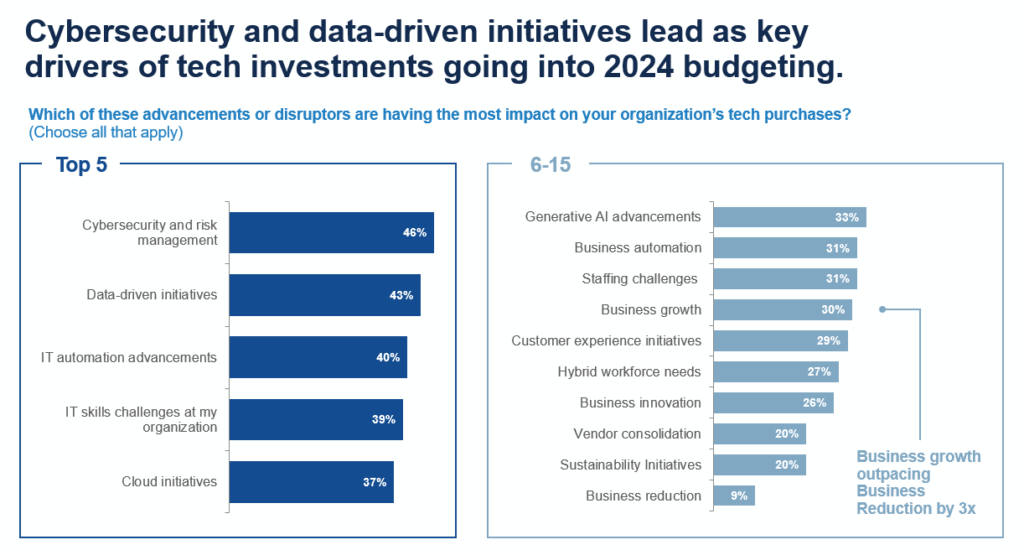

Let’s dig into the top five technology investment drivers – and disruptors – that will shape buyers’ tech investments in 2024:

1. Cybersecurity and Risk Management

With the increasing sophistication of cyberattacks exploiting organizations’ vulnerabilities, organizations are unsurprisingly prioritizing cybersecurity. Investments in multi-factor authentication, vulnerability management tools, email security, threat detection and response, and zero trust identity and access management will be crucial in mitigating these risks and protecting sensitive data.

2. Data-Driven Initiatives

Businesses are realizing the immense value of democratizing data to drive informed decision-making and improving operational efficiency. This is leading to increased investments in data analytics and BI platforms, data governance, and data science and machine learning (ML) solutions across various business functions, from marketing and sales to finance and operations.

3. IT Automation

Automation is rapidly changing the way IT departments operate. By automating routine tasks and processes, IT teams can free up time and resources to focus on strategic initiatives and innovation. Investments in Robotic Process Automation (RPA) and artificial intelligence (AI), specifically generative (GenAI), will continue to grow in 2024 as organizations look to ease the workloads of professionals.

4. IT Skills Challenges

The demand for skilled IT professionals is outpacing the supply, leading to talent shortages across various industries. Organizations are addressing this challenge by investing in employee training and development programs, adopting alternative talent acquisition strategies, and exploring automation solutions to address skill gaps.

5. Cloud Initiatives

Cloud computing continues to be a major driver as adoption unfolds for new workloads and companies renew their cloud investments. Specifically, we project organizations will expand their hybrid cloud, off-premises cloud (IaaS/PaaS) and multi-cloud deployments in 2024, alongside exploring the bevy of new cloud-based services.

Bonus driver: Generative AI

While still in its early development stages, GenAI is expected to become a major driver of tech investments next year, and we’re currently seeing a 909% growth in GenAI purchase intent activity. However, tech buyers harbor serious concerns with AI around trust, and prioritize instead engaging with pre-purchase content that is written by independent experts.

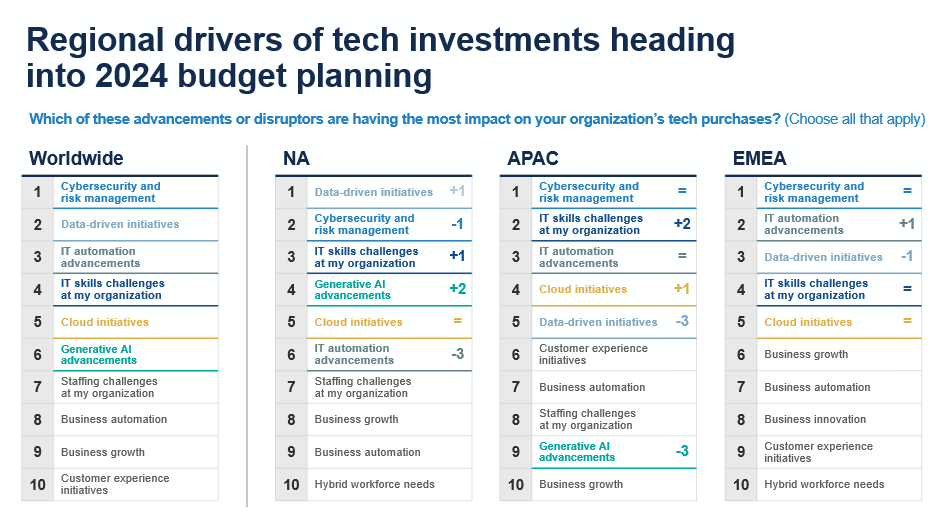

Regional drivers of tech investments

We see the growth of these top tech investment areas borne out into the specific regions highlighted in our results reel on the right. In North America, all those mentioned above rank in the top six (as having the most impact on buyers’ tech purchases), with data-driven initiatives just edging out cybersecurity for the #1 spot. In APAC, however, GenAI advancements rank much lower on this list of tech investment priorities. GenAI remains under scrutiny for APAC professionals, as they continue to evaluate its ethical concerns and assess viable use cases.

Cybersecurity and risk management maintain the top slot across APAC and EMEA. And, though lower on the list, an emphasis on cloud initiatives proliferates buyer concern across regions and industry types.

Better buyer connections begin by understanding their priorities

Even if your business does not sit within these top six drivers, they are still important for go-to-market (GTM) teams to keep in mind when refining strategies. By illustrating how your solution(s) dovetail with priority areas, you’ll better meet the needs of buyers. And, by providing educational content that helps buyers gain the knowledge they need to adapt to a changing ecosystem, you’re more likely to end up on their short list.

B2B content, b2b technology buyers, demand gen